It’s no surprise that banks like to make money, especially on mortgages. But, how much is your mortgage actually costing you?

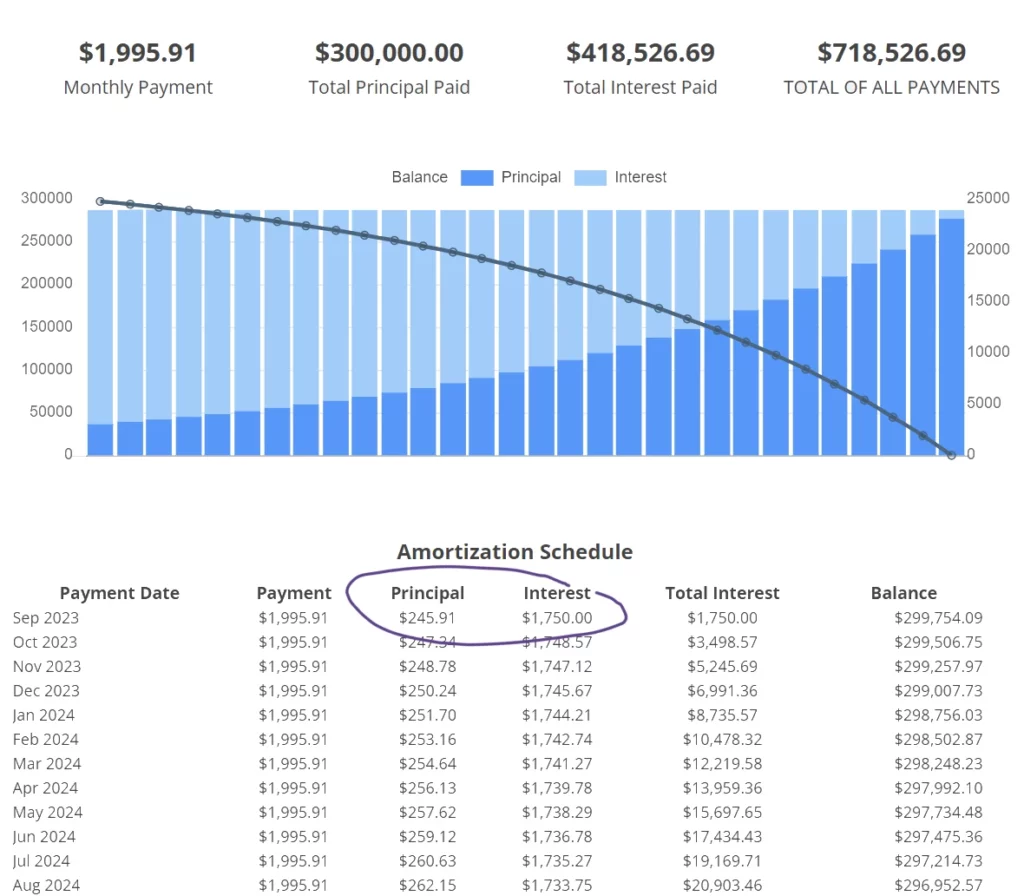

Did you know that in the first year of a $300,000 mortgage, you are paying the bank $20,903.45 in interest, while only paying $3,047.42 in principal?

And that by the end of your second year, you will have paid the bank $41,654.92 in interest, while only paying $6,315.16 in principal?

Did you know that you pay more money in interest than you put towards principal for the first 21 years of a 30 year loan?

And that a $300,000 mortgage will end up costing you $718,526.69 total, not counting property taxes, insurance, or fees.

But the worst part is that the average person only lives in their home for thirteen years before they move. And in many locations across the US, the average person only lives in their home for seven years.

After thirteen years of paying your mortgage on time, you will have paid a total of $175,188.59 in interest, and only $92,542.95 towards principal, which means you will still owe the bank $207,457.05 on your $300,000 mortgage.

After seven years of paying your mortgage on time, you will have paid a total of $90,721.54 in interest, and only $55,077.06 towards principal, which means you will still owe the bank $244,922.94 on your $300,000 mortgage.

In short, your mortgage is costing you a fortune.

This information is based on a $300,000 mortgage at a 7% interest rate. Your specific price calculations can be checked at SparkRental’s mortgage calculator tool. The length of time in a home information, can be found at the National Association of Relators website.