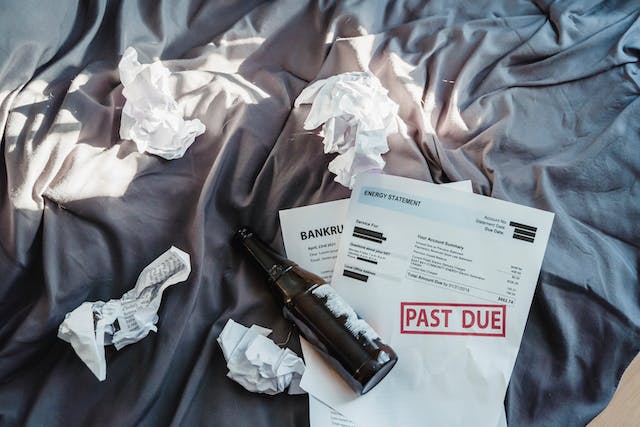

Debt can be daunting, but there are proven ways to get out of debt on a tight budget. By assessing your debt, controlling spending, and exploring consolidation options, you too can get out of debt, even with no money.

- Calculate Your Debt: Start by tallying up all your debts to understand the full picture. Knowing your debt-to-income ratio helps gauge your financial health.

- Avoid More Debt: Resist the temptation to take on new debt, which can prolong your journey to financial freedom. Stick to cash for expenses whenever possible.

- Set Up a Budget: Budgeting isn’t about restriction; it’s a tool to manage your money better. Track your income and expenses to prioritize debt payments while covering essential costs.

- Trim Expenses: Identify areas where you can cut back on spending, such as subscription services and dining out. Every saved dollar can go towards paying off debt faster.

- Negotiate Bills: Reach out to service providers to negotiate lower rates on bills like insurance and internet. Every reduction in expenses means more money for debt repayment.

- Choose a Repayment Strategy: Decide between the debt snowball or avalanche method to systematically pay off debts. Pick the approach that aligns with your financial goals and motivates you to stay on track.

- Pursue Side Hustles: Increase your income by taking on extra work or starting a side business. The additional funds can accelerate your debt payoff journey.

- Consider Consolidation: Explore debt consolidation options like loans or balance transfers to streamline payments and potentially lower interest rates. However, weigh the risks and benefits carefully.

- Seek Credit Counseling: Work with reputable professionals to develop a personalized debt repayment plan. Ensure you choose a credible agency to guide you through the process.

Getting out of debt with limited funds is challenging but possible. By implementing these strategies, you can take control of your finances and pave the way to a debt-free future. Start your journey to financial freedom now.