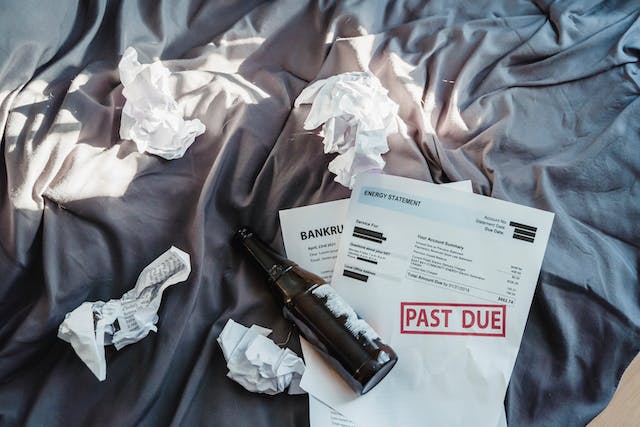

Credit card debt is a reality for millions of Americans, but how much debt does the average person carry, and what factors contribute to this growing financial burden? Understanding the trends in credit card debt is essential, especially in today’s economic climate where inflation, rising interest rates, and increased consumer spending are affecting many households. […]