I hate to say this, but you’re not going to win the lottery. Sorry, but it’s true. And money isn’t going to somehow magically appear in your bank account. Budgeting is the only way to win.

You need to know how to budget, because having a plan, and then executing that plan, is the only way to financial freedom.

That’s it. That’s the secret. And it’s not so hard once you get started.

Budgeting can be boring, sure, and it can be complicated if you let it be; involving spreadsheets, multiple apps, saving receipts, and spending hours putting all of it together.

But we don’t like that. That’s too hard.

Instead, we are going to break budgeting down to the simplest way we know, so that you can succeed instead of stress.

What is a budget?

A budget is a personalized plan that enables you track your income and expenses, to ensure you’re spending within your means and saving money.

Why do I need a budget?

A personal budget helps you manage your money effectively to help you make better financial decisions.

How to make a budget?

This is the easiest way to create a simple personal budget.

1st – Your Income

You must figure out how much money you make each month, and write it down.

If your monthly pay varies because your job, you want to base your budget off of your lowest income earning month.

Meaning, if you make $3,500 in August but only make $2,600 in December, you want to make your budget based on a $2,600 per month income.

2nd – Your Expenses

Write down your expenses into three (3) categories.

These three categories are

- Necessary Fixed

- Necessary Variable

- Wants

Necessary Fixed = Rent, mortgage, car payment, student loans, insurance, savings, investments, 401k, and any other bills that are the same every month.

Necessary Variable = Electricity, water, gas, food, child care, and anything else that is necessary but the price can change each month.

Wants = Cable television, Netflix, eating out, shoes, clothes, coffee shops, your cell phone, alcohol, video games, shopping, and basically any other expense that is not essential to living.

You should write all of these down on a single sheet of paper, and then ADD THEM UP.

You can do it by hand, but it is recommended that you do it on a computer and print it out.

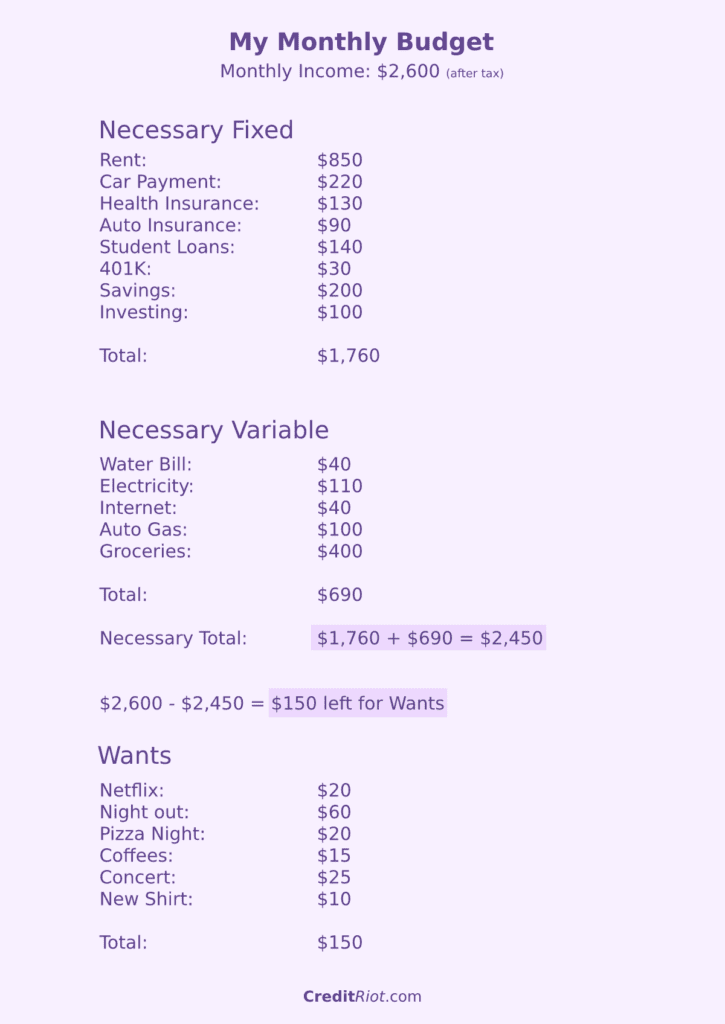

Here’s an example of what that would look like.

This example is for someone making about $20/hour working 40 hours a week.

Wait! Only $150 left for partying, shopping, coffee, pizza, and entertainment? No way.

Yes, you need to make sure all of your necessary expenses are paid off first. This includes money to your savings account, your investment portfolio, and your 401k.

These can all automatically be subtracted from your paychecks, and we recommend setting that up if you have difficulty including this in your monthly necessary expenses.

3rd: Stick to your budget. The easiest way to do this is to have a clear understanding of exactly where and how you’re spending money.

You know exactly how much your Necessary Fixed expenses are going to be, and probably a close estimate of your Necessary Variable expenses, but how do you properly track groceries and all those other small random expenses?

Sure, budgeting apps work, but only if you actually input the receipts. Instead, we like putting every single purchase on a credit card.

A credit card is better for budgeting than cash because it enables you to easily track every purchase.

We recommend only using one card at a time, and make sure you pay off your balance at the end of every month.

We do not recommend using a bank card that draws money directly from your bank account, as this makes tracking your expenses difficult.

By putting every single purchase on a single credit card, you can easily see how much your spending each month, and where you’re spending it.

Notice!! If you know you’re the type of person who gets into trouble with credit cards, or are currently in credit card debt, then we do not recommend using a card at this time.

But… budgeting is boring

Want to live the rest of your life in credit card debt? Never have the money for that house you want? Always live in fear of losing your job because you need that paycheck to pay your bills?

If those things are fine for you, then who cares about budgeting, stop reading and continue barely getting by.

But if you want the freedom to do what you want, when you want, you need to get your finances under control.

And the best way to do this is by budgeting.

Learning to live with less

To become financially free, you must learn to put off what you want today, in order to get what you really want some day.

We live in a hyper-consumerism world where everyone is telling you that you need the next new thing to be happy: a better car, a new outfit, new phone, cool shoes, or even a photo worthy meal.

But the truth is, none of this stuff makes you happier in the long run.

Once you start budgeting and seeing where your money actually goes and how much of it is wasted, you will learn what is and isn’t important to you, and what you truly value.

This self-realization will make you a happier, healthier, wealthier, and wiser person, and that’s going to make it even easier to save money.