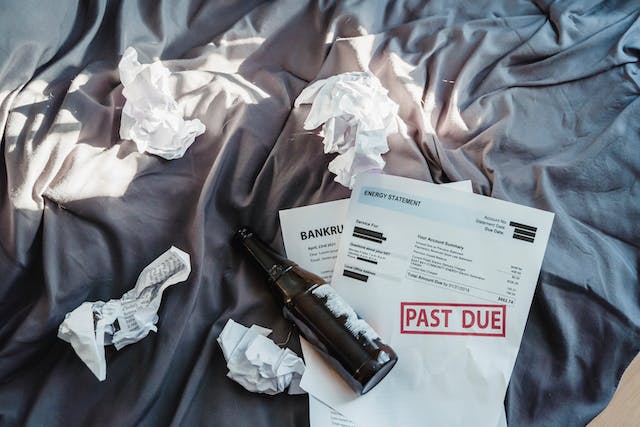

If you’re struggling with credit card debt, many are. People find themselves in your same situation due to overspending or unexpected financial challenges. However, there are strategies you can use to pay off your credit card balance and take control of your financial life. Here, we’ll explore a few of these strategies and provide tips […]