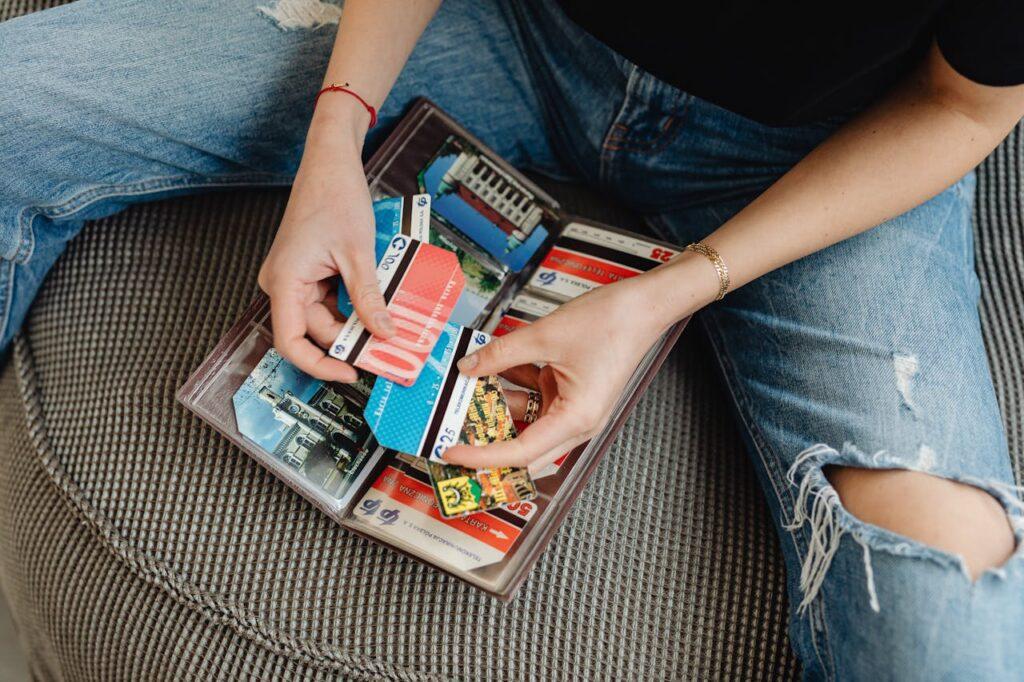

Are you deep in debt and need answers? Here’s a quick guide how you can get rid of up to 30k in credit card debt. It’s not going to be easy, but you can do it. We believe in you.

Step 1: Assess Your Debt

Before you start tackling your credit card debt, take a comprehensive look at your financial situation. Gather all the necessary information, including the amounts you owe, interest rates, minimum payments, and due dates. Knowing your total debt and monthly payments will help you create a realistic plan for paying it off.

Step 2: Resist Temptation and Maximize Income

To avoid accumulating more debt, opt out of receiving new credit card offers. Focus on maximizing your current income by reducing non-essential expenses. Consider cutting back on subscriptions or other monthly services to free up more money for debt repayment.

Cut everything that isn’t required. You’re deep in debt, and every day you’re probably wasting money on things you don’t need. Stop! Even just $5-10 dollars a day is $150-300 less a month you can be putting towards getting out of debt.

Step 3: Automate Payments

Ensure that you never miss a payment by automating your payments. This will help maintain your credit score, as payment history is a crucial factor. Set up automatic payments from your bank account to cover at least the minimum amount due each month.

Step 4: Pay Extra

Make extra payments whenever you can, no matter how small. Every additional dollar you put towards your debt reduces the principal amount and saves you money on interest in the long run. Even small, regular extra payments can add up over time and accelerate your debt payoff.

Step 5: Review and Adjust Your Plan Regularly

Periodically review your debt payoff plan to ensure it still aligns with your financial goals and lifestyle. Consider refinancing your debt with a balance transfer credit card to reduce interest costs. Keep track of your progress and celebrate each milestone to stay motivated.

Step 6: Increase Your Efforts as You Progress

As you become more comfortable with your debt repayment plan, look for ways to accelerate your progress. Consider refinancing for better terms or finding additional sources of income. Monitor your credit score, as reducing your credit card balances will likely improve your score over time.

Bonus Tips to Escape Credit Card Debt

- Can I negotiate with my credit card company to lower my interest rate?

- Yes, it’s possible to negotiate a lower interest rate with your credit card company, especially if you have a good payment history. Contact your issuer and explain your situation to see if they can offer you a better rate.

- Should I consider debt consolidation?

- Debt consolidation can be a useful strategy for simplifying your payments and potentially reducing your interest rates. However, it’s important to carefully consider the terms and fees associated with any consolidation offer to ensure it’s the right choice for you.

For more information on managing debt, visit the Federal Trade Commission’s website at www.ftc.gov/debt.

Additional Resources